Active regret – how to write, template

Sometimes, out of the busyness of things, we happen to forget important obligations. As taxpayers, we have to comply with the rules and settle our tax return every year. What if we forget to submit our PIT to the Tax Office? Active regret is here to help! What is an active regret, when to apply it? Who can file an active regret? What changes have been introduced in 2023 in relation to active regret? How do you write an active regret? Check out our article!

CONTENTS:

- Active regret – what is it, who can benefit?

- What can be the reason for active regret?

- When will active regret be effective?

- When can active regret not be used?

- PIT settlement 2023 – by when?

- Penalties for failure to file a tax return – changes in 2023

- Electronic active regret

- How to write the letter? Model of active regret

Active regret – what is it, who can benefit?

An active regret is a document that you submit when you have committed a tax offence. It is an admission of guilt and an expression of willingness to settle matters with the Tax Office. Anyone who has committed a fiscal offence may submit an active regret. In it, one should write why one has not settled the PIT return by the specified deadline.

According to the government’s website www.gov.pl: active regret is an institution regulated in Article 16 of the Fiscal Penal Code that allows waiving punishment for offenders who have expressed “remorse” for committing a criminal act and have fulfilled their obligations.

Legal basis:

Article 16 § 1 Fiscal Penal Code:

A perpetrator who, after committing a criminal offence or a fiscal offence, notifies the authority appointed for prosecution of the offence, disclosing the essential circumstances of the offence, in particular the persons cooperating in its commission, shall not be subject to punishment for a fiscal offence or a fiscal offence.

What can be the reason for an active regret?

An active regret is lodged when a situation of a prohibited fiscal act occurs. It may allow one to avoid fiscal criminal liability, but it is not a recipe for everything. Filing an active regret in situations that are not described in the Fiscal Penal Code will be ineffective. What offences does active contrition apply to? The institution of active regret may be used when:

- Failed to submit a tax return on time

- Wrongly issued an invoice

- Unreliably kept books of account

- Failure to pay income tax (CIT/PIT) or VAT

- Falsified customs permission

- Fraudulent reimbursement of customs duties

- Illegally applied reduced VAT rates

- Illegally applied VAT exemption

- Disguised the true extent of business activity

The Fiscal Penal Code does not stipulate a specific deadline within which an active regret must be received by the Tax Office.

When will an active regret be effective?

The effectiveness of an active regret is actually decided by the taxpayer himself. The filing of such a letter should take place before the competent tax authority has documented the commission of an offence. It is important to acknowledge the mistake before the law enforcement authority discovers the offence.

Active regret WILL NOT BE EFFECTIVE when the taxpayer:

- is under criminal investigation

- has incited others to commit a tax offence

- has organised a group with the aim of committing an offence

- has been summoned by the Tax Office and the tax authorities have documented the offence committed

In order for the active repentance to be effective, you must fulfil your obligations towards the head of the tax office or the tax and customs office, in particular submit outstanding tax declarations or pay public law dues in full, including interest. The payment must be made within the deadline set by the authorised pre-trial authority.

According to the provisions in the Fiscal Penal Code, an active grudge does not have to be filed if the taxpayer has submitted a correction to his declaration.

! It is a myth that active regret allows to avoid criminal liability for all fiscal offences.

Read also: Minimum wage 2023 – how much is the lowest national wage?

When is it not possible to use active regret?

Legal basis:

According to the provisions mentioned in Article 16 of the Fiscal Penal Code:

Ҥ 5. A notification is ineffective if it is made:

1) at a time when the law enforcement agency already had clearly documented knowledge of the commission of a fiscal offence or fiscal misdemeanour;

2) after the law enforcement body has commenced an official activity, in particular a search, a checking activity or an inspection aimed at disclosing a fiscal offence or a fiscal misdemeanour, unless this activity has not provided grounds for initiating proceedings for this offence.”

PIT settlement 2023 – by when?

The PIT for 2022 must be filed by the deadline: from 15 February to 2 May 2023. If you do not manage to file it by the given deadline, you must immediately go to the relevant tax office, file an active regret there and pay any interest. You can submit your overdue PIT in person at the tax office, by post or electronically via: E-deklaracje.

Penalties for failure to file a tax return – changes in 2023

Failure to file a PIT return is punishable. A taxpayer may be called to account for committing an offence or a criminal offence. Which category he or she is assigned to depends on the length of the delay and the amount of unpaid tax. Each case is settled one by one. The reason for the active regret is important, e.g. a bad life situation or a way of avoiding taxes.

The penalties for tax offences depend on the applicable minimum wage. In 2023, the minimum rate will change twice. From January to 30 June, the national minimum applies: PLN 3490, from 1 July it will change to PLN 3600 gross.

The amount of the penalty depends on the type of act committed. What is the difference between a fiscal offence and a misdemeanour?

- a fiscal offence – an act whereby the amount of public receivables evaded or threatened with evasion does not exceed 5 times the amount of the minimum remuneration

- fiscal offence – an act that exceeds 5 times the minimum wage.

As of 1 January 2023, the limit between a misdemeanour and a fiscal offence is PLN 17,450, and will increase to PLN 18,000 as of 1 July 2023.

The fine for a fiscal offence is set from 1/10 to 20 times the minimum wage. In the first half of 2023, the fine for the offence will range from PLN 349 to PLN 69,800. In the second half, it will range from PLN 360 to PLN 72,000.

The punishment for a fiscal offence may be: a fine in daily rates, restriction of liberty, imprisonment.

The amount of the penalty for a fiscal offence is set in daily rates – from 10 to 720. It may not be less than 1/30 of the minimum wage, nor exceed 400 times that part. Until 30 June, the lowest daily rate is PLN 116.33 and the highest is PLN 46,532. From 1 July, it will change to PLN 120 to PLN 48,000. The maximum fine for a fiscal offence in the first half of the year is PLN 33,503,040 and PLN 34,560,000 in the second half.

Read also: Start-up relief

Electronic active regret

A letter of active regret can be submitted stationary at the Tax Office of your choice, send an active regret by post or submit it online. An electronic active grievance can be filed via EPUAP or e-Fiscal Office.

An active regret should be filed online if you want to save your time. This process only takes a few minutes.

How to send an active regret electronically?

The perpetrator of the criminal act must go to the government website www.urządskarbowy.gov.pl and log in using:

- Trusted Profile

- E-proof of identity

- mCitizen application

- Electronic banking

- Authorisation data

Active repentance – how to write it?

The law does not specify the form of an active regret, nor is there a single template. An active regret must include the most important data of the taxpayer and the reason for submitting the document. The perpetrator of the tax offence must include the information:

- Date and place

- Data of the person submitting the active regret

- Data of the addressee (Tax Office or Tax and Customs Office)

- Reason for the act

- Information about the correction of the offence

- Signature

The content of the active regret should be written in formal language. The taxpayer’s active regret should have a specific reason as to why the fiscal offences were committed. If this is the first time such a situation has arisen, it is worth mentioning this in your

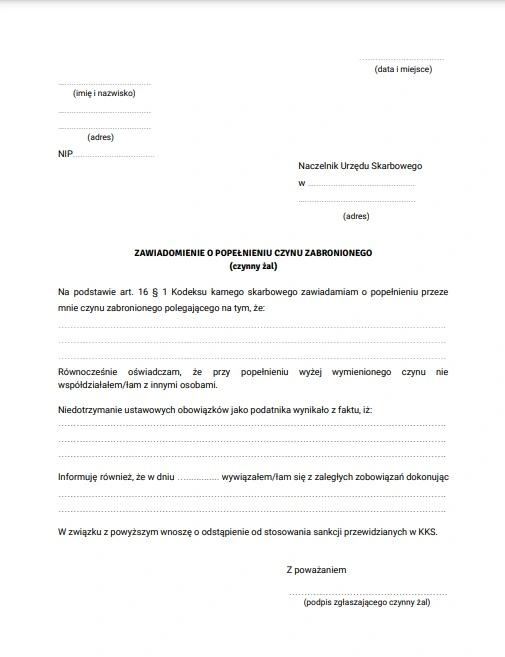

Active regret – formula

We provide a general formula for active regret:

Source: www.infor.pl

Summary

- The document of active regret is submitted by the perpetrator of the tax offence, i.e. the individual who committed it.

- The taxpayer who has violated the tax legislation must expect that the tax authority will initiate fiscal criminal proceedings.

- If the active regret was filed too late, the tax authority must be notified quickly.

- The recognition of an active regret as effective depends on how quickly the taxpayer admits to having made a mistake.

- If you file an active regret after the tax authority has initiated proceedings it will be ineffective.

- An active allows you to avoid liability, but an active regret does not always protect you from punishment.

- Active regret is mainly applicable in the case of failure to settle PIT on time, but also in other situations.

- Once an active regret has been filed, the tax authorities are not obliged to inform about the application of the provision.

- The Code does not provide information on the deadline for filing an active regret.

- The notice of active regret does not have to be made personally, but can even be made by another person acting on the instructions of the offender

- Traditionally, active regret has been submitted in the usual written form, i.e. in the form of a letter that contains the relevant elements required by the Code of Criminal Procedure.

Make use of the institution of active regret by informing the head of the tax office or the head of the customs and revenue office that you have committed a fiscal offence. This will give you the opportunity to avoid a penalty. It is important to remember that a prior notice to the tax authority is required for the active regret to be effective. Therefore, an active regret may be ineffective if it is sent after the investigation of the Tax Office.

Having trouble finding a job? Talk to us! We are an employment agency that has already been operating for 10 years on the labour market –> Contact us <–.

Check also: How to negotiate salary?

Back

Back